AMD NASDAQA MD Should you consider investing in Advanced Micro Devices (AMD) given the upbeat sentiment on Wall Street?

When considering investment decisions such as buying, selling, or holding stocks, investors often turn to analysts’ recommendations. Reports in the media regarding rating adjustments by these analysts, who are employed by brokerage firms (also known as sell-side analysts), often affect a stock’s price. However, the question arises: are these recommendations really important?

Before getting into the reliability of brokerage recommendations and how to take advantage of them, let’s explore what Wall Street experts are saying about Advanced Micro Devices (AMD).

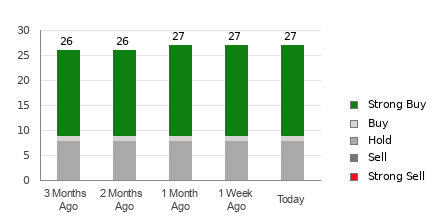

As of now, Advanced Micro Devices has an average brokerage recommendation (ABR) of 1.35 on a scale of 1 to 5 (Strong Buy to Strong Sell). This ABR is derived from actual recommendations (buy, hold, sell, etc.) provided by 30 brokerage firms. An ABR of 1.35 falls roughly between Strong Buy and Buy.

Of the 30 recommendations contributing to the current ABR, 24 are rated as strong buy, while one is labeled as buy. Overall, Strong Buy and Buy make up 80% and 3.3% of all recommendations, respectively.

While the average brokerage recommendation (ABR) suggests buying Advanced Micro Devices, it is important not to base investment decisions solely on this information. Several studies have shown limited or lack of success in brokerage recommendations that guide investors to select stocks with the highest potential for price appreciation.

The reason behind this is the inherent bias of brokerage analysts, driven by vested interests of brokerage firms in the stocks they cover. Our research shows a significant positive bias, with brokerage firms assigning five “Strong Buy” recommendations for every “Strong Sell” recommendation.

This misalignment of interests with retail investors often fails to accurately identify the potential direction of a stock’s price. Therefore, the wisest use of this information may be to validate your own research or rely on indicators with a proven track record to predict stock price movements.

Our proprietary stock rating tool, ZacksRank, offers an externally audited impressive track record. Ranking stocks into five categories, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serves as a reliable indicator of a stock’s short-term price performance. Thus, the cross-reference of Zacks Rank with ABR can play an important role in making informed and profitable investment decisions.

Zacks Rank Should Not Be Confused With ABR

AMD NASDAQA MD

Although the Zacks Rank and ABR both use a 1-5 range, they represent separate measures.

ABR depends entirely on brokerage recommendations and is usually expressed as a decimal (eg, 1.28). In contrast, the Zacks Rank is a quantitative model that enables investors to benefit from revisions to earnings estimates, presented as whole numbers from 1 to 5.

Brokerage analysts, because of the vested interests of their employers, have historically exhibited an overly optimistic bias in their recommendations. Their ratings tend to be more favorable than their research, leading to misleading guidance for investors.

On the other hand, the Zacks Rank is based on earnings estimate revisions, with empirical research indicating a strong correlation between near-term stock price movements and earnings estimate revision trends.

Another important distinction is the application of various Zacks Rank grades, which are assigned to all stocks proportionally to the current year’s earnings estimates provided by brokerage analysts. This ensures balanced representation across the five ranks.

Freshness is another factor that separates ABR and Zacks Rank. ABR may not always reflect the most recent information, while the Zacks Rank is inherently timely. This is attributed to brokerage analysts constantly adjusting their earnings estimates to accommodate changing business trends, and these changes are immediately incorporated into the Zacks Rank, which simulates future prices. and provide up-to-date insights into the movement.

Should You Invest in AMD NASDAQA MD?

In terms of earnings estimate revisions for Advanced Micro, the Zacks Consensus Estimate for the current year has increased 0.4% over the past month to $2.65.

Analysts’ growing optimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more. They’ve already closed 162 positions with double- and triple-digit gains in 2023 alone.

[…] AMD NASDAQA MD […]

[…] AMD NASDAQA MD […]